The Power Behind Compound Interest

When it comes to building long term wealth, one concept quietly does a lot of the heavy lifting: compound interest. Understanding how it works and more importantly, how to use it can radically shift the way you approach saving and investing.

What Is Compound Interest?

At its simplest, compound interest means earning interest on your interest. Unlike simple interest, which only earns returns on the initial principal, compound interest allows your total balance to grow faster over time.

Plain Definition:

You earn interest on your initial investment (the principal)

That earned interest is reinvested automatically

Going forward, both your original money and the accumulated interest earn more interest

It’s the difference between just saving money in a shoebox and letting your money go to work for you.

Money Making Money Over Time

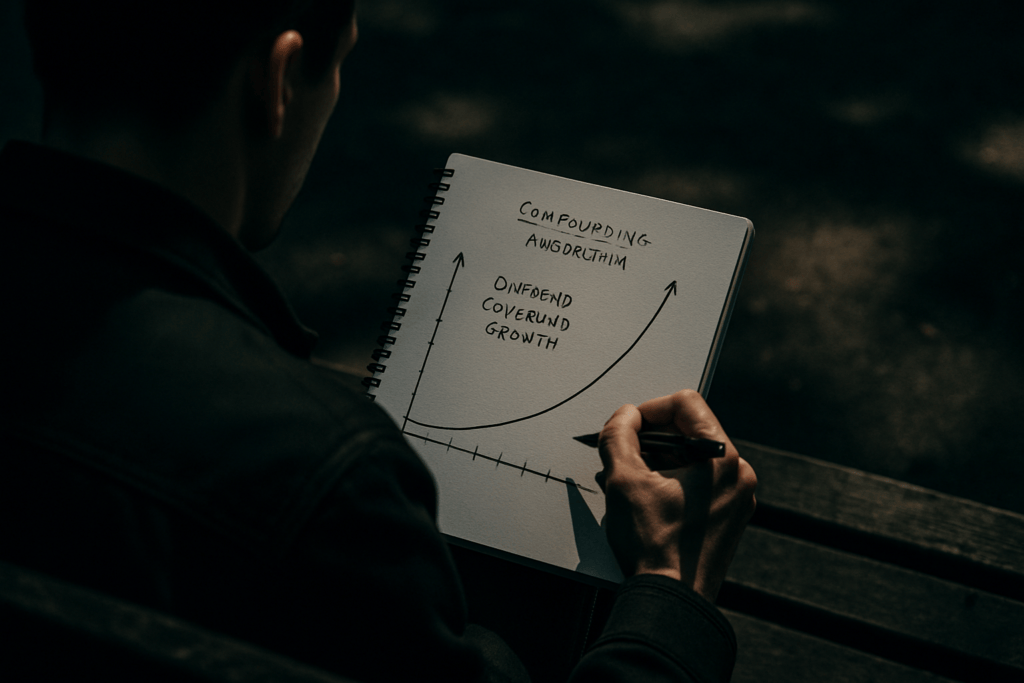

The true power of compound interest reveals itself with time. Even small, regular contributions can snowball into significant wealth given enough years. Here’s how the growth unfolds:

Year 1: You earn interest on your initial deposit

Year 2 and beyond: You earn interest on both the starting deposit and the interest from previous years

The longer your money stays invested, the more exponential the growth becomes

Why Starting Early Is a Game Changer

You don’t need to start with a large lump sum what matters most is giving your money time to multiply. In other words, starting early can beat starting big.

Here’s why timing matters:

A person investing $100/month starting at age 25 can outperform someone investing $200/month starting at age 35

The first investor’s smaller contributions have more time to grow

Compound growth accelerates dramatically after 10 20 years of consistent investing

It’s not magic it’s math. And it firmly favors those who begin early, even with modest amounts.

Key Takeaway: The sooner you start, the less effort you need later. Compound interest turns time into a powerful wealth building tool.

Breaking Down the Math

Understanding compound interest doesn’t require a finance degree. Here’s how it really works, with simple math and practical comparisons to help you see its power in action.

The Basic Formula

At its core, compound interest follows this formula:

A = P(1 + r/n)ⁿᵗ

Where:

A = future value of the investment

P = initial principal (starting amount)

r = annual interest rate (as a decimal)

n = number of times interest is compounded per year

t = number of years

You don’t need to memorize this, but understanding the variables will help you make informed financial decisions.

A Simple Example: $100 Per Month

Let’s compare two scenarios over 30 years, assuming a 7% annual return:

Scenario A: You invest $100 every month, compounding monthly

Scenario B: You put $36,000 in a box ($100/month x 360 months) and let it sit

The results?

Compound Investment (Scenario A): Grows to about $121,000

No Growth (Scenario B): Remains at $36,000

That’s the difference compound interest makes. You earn interest not just on your contributions but on the interest itself.

Why Compounding Frequency Matters

The more frequently your interest is compounded, the faster your money grows. Here’s how it plays out:

Annual compounding: Slower growth

Monthly compounding: Faster, thanks to more regular interest

Daily compounding: Even better (commonly used in high yield savings accounts)

Tip: When comparing financial products, check how often interest is compounded. It makes a real difference over the long term.

Understanding the basics of how compound interest works and how different strategies affect outcomes is your first step toward building lasting wealth.

Time vs. Amount: What Matters More

Trying to time the market perfectly is a losing game. Even experts get it wrong. And while chasing the perfect moment might feel strategic, it rarely pays off the way people expect. The real edge? Time in the market.

Take two investors. One starts investing $200 a month at age 22 and stops at 32. The second starts putting in $500 a month at 40 and plans to go until 60. On paper, Investor 2 is doing more more money, longer timeframe. But Investor 1, with just a 10 year head start, can end up with more wealth at retirement, thanks to compound growth doing its thing quietly in the background.

This isn’t magic. It’s just math fueled by patience. Money needs time to double, then double again. Starting early gives your money longer to work, even if you invest less. You can’t rewind time, but you can make a call today that sets a future you up for more freedom.

The lesson? Don’t wait for the perfect conditions. Perfect doesn’t exist. Consistency small, regular contributions over time is what builds unshakable financial foundations.

Using Compound Interest to Hit Specific Wealth Milestones

Compound interest isn’t just a math trick it’s how ordinary people reach major financial goals without winning the lottery. Whether you’re thinking about retirement, buying a home, or leaving something behind for the next generation, compound growth stacks in your favor if you give it time and direction.

The first step is simple: define the goal. A comfortable retirement? A down payment in five years? Leaving a trust for your kids? Each one has a timeline, and that matters. Compound interest works best when there’s a long road ahead, which makes early action powerful.

Aligning your growth path with clear long term financial goals keeps you focused. It also makes it easier to choose the right tools. For safe but steady growth, high yield savings accounts work well in the short term. For longer timelines, investment portfolios and Roth IRAs offer tax advantages and potential for bigger compounding gains.

The key is regular contributions. Slowly stacked, automatically invested. Let the compounding do the heavy lifting while you focus on living.

Avoiding Common Pitfalls

Compound interest works best when it’s left alone. Withdrawing too early, especially before your money has had time to snowball, kills the momentum. It’s like yanking bread out of the oven halfway through baking sure, it’s something, but it’s not what it could’ve been. Every time you pull funds before your timeline, you’re not just taking out cash you’re cutting future growth off at the knees.

Same goes for skipping contributions. The whole engine runs on consistent input. Missed months or years don’t just delay your goals they can shrink them. Habits matter more than hacks here.

Then there’s inflation. Prices rise whether your money does or not. Leaving cash in a low interest savings account means you’re likely falling behind. Compound interest, especially through smart investing, is one of the few tools that can outpace inflation over the long haul. It’s not just about growth it’s about staying ahead.

Locking In Your Strategy

Consistency beats intensity, especially when it comes to growing long term wealth. The easiest way to stay consistent? Automate it. Set up recurring contributions to your investment accounts weekly, bi weekly, monthly, whatever fits. The point is to remove decision fatigue. No more forgetting to invest. No more second guessing the timing. Just smooth, regular deposits that build up momentum behind the scenes.

Tracking your growth year by year isn’t about obsessing over every dip or spike. It’s about making sure your plan is working. Reviewing your portfolio annually gives you a clear picture of whether your strategy is aligned with your timeline and tolerance. Need to tweak your allocations? That’s when you do it with data, not vibes.

Finally, don’t forget the big picture. Revisit your long term financial goals regularly. Life shifts. Priorities change. Your compound interest machine should reflect your current values not just your original intentions. Keep it on track, and let time keep doing its job.

Bottom Line: Let Time Work for You

Compound interest doesn’t play favorites it just rewards those who stay in the game. The longer your money has to do its thing, the bigger the payoff. That’s why patience isn’t just a virtue it’s a multiplier.

Starting early means you don’t have to start big. A modest monthly contribution when you’re 22 can outgrow a hefty deposit at 40. It’s about giving your money the runway it needs to take off not waiting until conditions are perfect.

Consistency beats bursts of activity. You don’t need to be rich to build wealth. You need rhythm. Small, repeatable actions over time create something solid something you can count on.

Don’t chase quick wins. Put your system in place. Let it run. Let time do its job.