Begin Investing Today: A Guide to Start with a Small Amount of Money

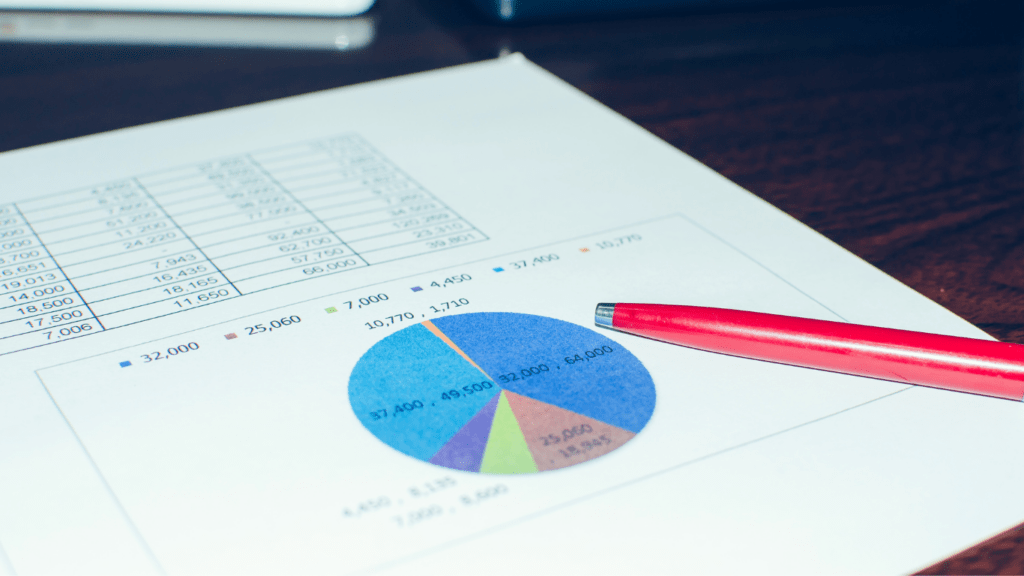

Understanding Small Investment Investing with limited funds seems challenging, but it’s achievable with the right mindset and approach. Comprehending the potential of small investments involves recognizing that even minimal contributions to a portfolio can accumulate over time through compound interest. For instance, investing $100 monthly with a 7% annual return could grow to over $8,000 […]

Begin Investing Today: A Guide to Start with a Small Amount of Money Read More »