Understanding Dollar-Cost Averaging

Dollar-cost averaging simplifies investing in unstable markets. It involves regularly investing a set sum regardless of market conditions.

Definition and Concept

Dollar-cost averaging (DCA) refers to a consistent investment strategy where an investor places a fixed dollar amount into a specific investment at regular intervals, such as monthly or quarterly. This approach means buying more shares when prices decrease and fewer shares when prices increase. By following this disciplined routine, I avoid trying to time the market, which often leads to emotional decision-making and increased risk.

Historical Background

The concept of DCA has roots in the early 20th century when it emerged as a response to market volatility during economic downturns. Initially popularized during the Great Depression, this method gained traction as investors sought ways to navigate uncertain economic conditions. Over time, various studies and financial experts have reinforced its effectiveness. As a result, DCA remains a favored strategy by many investors looking to reduce risk while steadily building wealth.

Benefits of Dollar-Cost Averaging

Dollar-cost averaging (DCA) offers distinct advantages for investors navigating unpredictable markets, making it a compelling strategy.

Risk Mitigation

DCA lowers the risk of investing a lump sum at a market peak. By spreading investments over time, I reduce the chance of making poor timing decisions. This approach buffers me against sudden market downturns, as not all my capital is exposed at once.

Emotional Discipline

Investing consistently requires maintaining emotional discipline. DCA keeps me focused on my long-term goals, avoiding impulsive decisions driven by market fluctuations. Regular contributions cultivate a habit of investing, reducing anxiety about market movements.

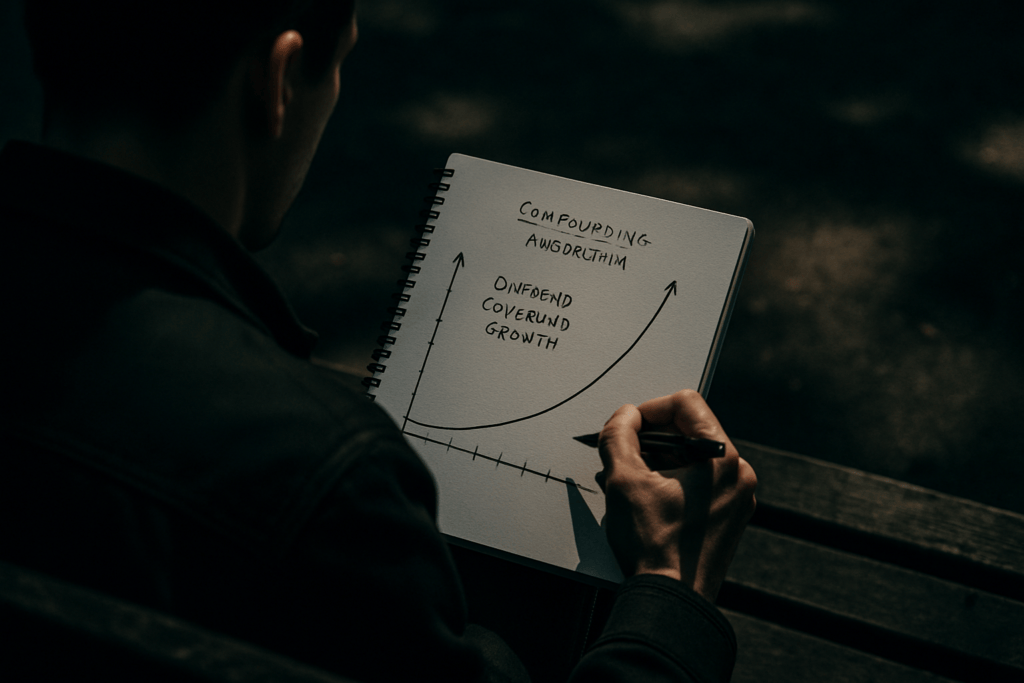

Market Volatility Management

In volatile markets, DCA’s systematic approach allows me to purchase more shares when prices fall and fewer when they rise. This averaging effect can result in a lower average purchase cost, enhancing returns as market conditions stabilize. It aligns my strategy with natural market cycles, offering a more measured way to engage with market volatility.

Implementing Dollar-Cost Averaging in Your Investment Strategy

Dollar-cost averaging (DCA) fits seamlessly into various investment strategies. Its focus on consistency and discipline makes it ideal for long-term financial planning.

Setting Investment Goals

I start by defining clear investment goals, which guide my DCA plan. Specific objectives drive my strategy, whether saving for retirement, building a college fund, or purchasing a home. Each target determines the amount and duration of my investments.

Determining Investment Schedule

A regular investment schedule enhances DCA. Let’s say, for example, I might invest a fixed sum every month or quarter, depending on my financial situation and market conditions. Consistency remains key, ensuring I’m buying shares regardless of market prices.

Monitoring and Adjusting the Plan

I consistently review my DCA strategy to ensure alignment with my original goals. Market fluctuations might prompt adjustments; for instance, increasing or decreasing my investment amounts as my financial situation changes. This flexibility allows me to maintain momentum toward achieving my financial objectives.

Dollar-Cost Averaging vs. Lump-Sum Investing

In volatile markets, dollar-cost averaging (DCA) and lump-sum investing represent two distinct strategies. Both offer unique approaches to managing investment risks and opportunities.

Pros and Cons Comparison

Dollar-Cost Averaging:

- Risk Mitigation: Spreads investment over time, reducing the chance of investing all capital at a market peak. This incremental approach aligns investments with market cycles.

- Emotional Discipline: Encourages consistent investing, helping to manage anxiety and avoid impulsive decisions based on market fluctuations.

- Potential for Lower Cost Per Share: Buys more shares when prices are low, potentially decreasing average cost per share over time.

Lump-Sum Investing:

- Immediate Market Exposure: Allows for full exposure to market gains when invested, which can be beneficial in a rising market.

- Higher Early Returns: Can lead to higher returns if invested before a strong market uptrend.

- Increased Risk: Higher risk if the market declines immediately after investment, potentially leading to significant losses.

Real-World Performance Scenarios

Historical data shows that the performance of DCA and lump-sum investing varies based on market conditions. During slow or declining markets, DCA often outperforms by capitalizing on lower share prices and reducing risk. For instance, investors using DCA during the 2008 financial crisis benefited from buying shares at reduced prices throughout the downturn.

Conversely, in rapidly rising markets, lump-sum investing can yield higher returns because all capital is deployed to capture early market gains. A lump-sum investment at the beginning of a bull market maximizes exposure to upward trends, thus outperforming DCA’s gradual approach.

Ultimately, the choice between DCA and lump-sum depends on timelines and risk tolerance. By understanding past market scenarios, I can tailor strategies to match individual goals and financial situations.