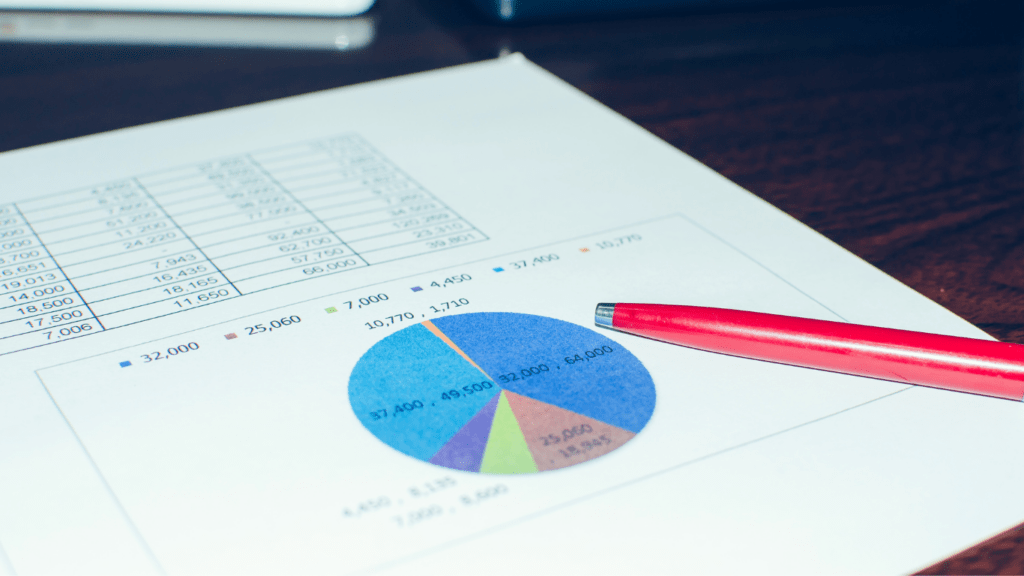

Understanding Investment Strategies

Investment strategies guide my decisions and actions in the financial markets. Key factors such as time horizon, risk tolerance, and financial goals shape effective strategies. They help me determine the appropriate balance between risk and potential return.

- Long-Term Strategies focus on buying and holding investments over several years or decades. They often entail selecting assets like stocks, bonds, or real estate that show potential for consistent growth over time. Because these strategies aim to weather market fluctuations, they’re ideal if I’m looking for gradual wealth accumulation.

- Short-Term Strategies involve active trading over days, weeks, or months. These strategies require identifying quick opportunities and reacting to market volatility swiftly. Tools such as technical analysis and market trends help me make these fast-paced decisions.

In both approaches, analyzing market conditions, economic indicators, and personal financial situations is crucial. Choosing a suitable strategy allows me to optimize my investment portfolio according to my unique financial journey.

Long-Term Investment Strategies

Long-term investments focus on holding assets like stocks or real estate for extended periods. This approach seeks to harness the power of compound interest and market growth.

Benefits of Long-Term Investing

Long-term investing offers several advantages. Compound interest increases potential returns over time. For example, reinvested dividends from stocks can significantly boost portfolio value. Reduced transaction costs come from less frequent trading, saving on fees and taxes. Additionally, holding assets long-term allows for capital gains tax benefits, as assets held for over a year typically enjoy lower tax rates in many jurisdictions. Consistency in staying invested through market cycles often results in overall growth, leveraging market recoveries.

Risks Involved in Long-Term Investing

While beneficial, long-term investing has inherent risks. Market volatility can cause significant portfolio value fluctuations, testing an investor’s patience. Inflation may erode purchasing power, impacting investment value over time. Changes in company performance or management can affect asset returns, especially in the stock market. Economic downturns might lead to losses or slower growth, requiring resilience and a focus on long-term goals to maintain course.

Short-Term Investment Strategies

Short-term investment strategies focus on quick and frequent trades to capitalize on immediate market movements. This approach appeals to those seeking rapid returns and is often characterized by active management and constant monitoring.

Advantages of Short-Term Investing

- Liquidity: Short-term investments provide quick access to funds (e.g., money market instruments) since they’re often held for a period of days to several months. This flexibility can be crucial for meeting immediate financial needs.

- Profit Potential: By leveraging market fluctuations (e.g., stock price shifts), investors can achieve significant returns in a short period. This profit potential attracts traders interested in high-paced financial environments.

- Less Exposure to Long-Term Risks: Short-term strategies avoid prolonged exposure to risks like inflation or significant economic changes. These investments typically focus on profiting from temporary trends or market inefficiencies.

- Transaction Costs: Frequent buying and selling result in high transaction costs. Fees can substantially reduce profit margins, especially in volatile markets where trading intensity increases.

- Market Volatility: Short-term investments require constant monitoring and swift reactions (e.g., day trading). This necessity for immediate action can lead to hasty decisions and financial losses.

- Tax Implications: High-frequency trades often face higher capital gains taxes compared to long-term holdings. Short-term gains are taxed as ordinary income, which can diminish net returns.

By considering these advantages and drawbacks, I aim to enable readers to align their investment strategies with their financial goals, ensuring an approach that complements their risk appetite and lifestyle.

Factors to Consider When Choosing an Investment Strategy

Investment strategies hinge on personal circumstances. Key considerations include financial goals and timelines, and risk tolerance.

Financial Goals and Timelines

Investment timelines play a crucial role in strategy selection. Long-term investment strategies align well with goals several years or decades away, like retirement or education funds. This approach allows wealth accumulation over time. If the timeline is shorter, like saving for a home, short-term strategies can provide quicker access to funds. Ensure alignment between investment methods and personal financial milestones.

Risk Tolerance and Market Volatility

Understanding risk tolerance is essential in shaping investment choices. If comfort with market volatility is high, short-term strategies might be appealing, offering the potential for rapid gains but with inherent risks. Conversely, if a preference for stability exists, long-term investments in diverse portfolios can help mitigate risks, providing a buffer against market fluctuations. Balancing risk appetite with investment strategy can lead to financial harmony.