Understanding Compound Interest

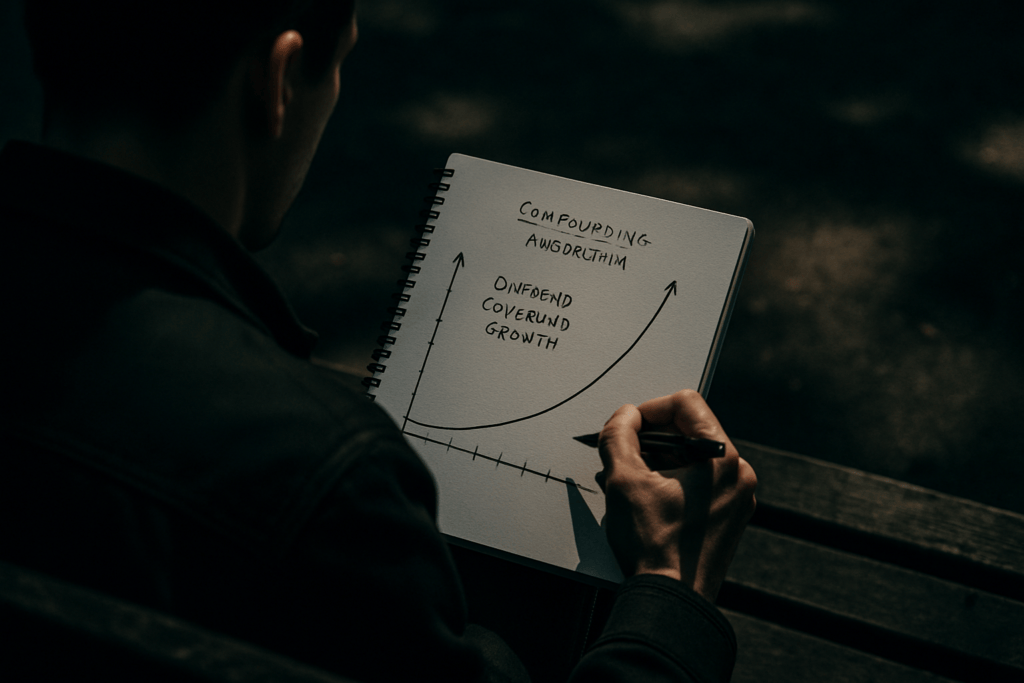

Compound interest, a core concept in finance, allows your money to grow faster than simple interest. It involves earning interest on both the initial principal and the accumulated interest from previous periods. This process continues over time, effectively multiplying your investment.

Consider a $1,000 investment with an annual interest rate of 5%. With simple interest, you’d earn $50 each year. However, with compound interest, you’d earn $50 in the first year and additional interest on that $50 in subsequent years. By the end of ten years, this compounding effect can result in capital significantly larger than the straightforward addition of each year’s interest.

The frequency of compounding plays a vital role. Interest can compound annually, semi-annually, quarterly, or even daily. More frequent compounding results in more interest accrued. For example, at the same 5% rate, daily compounding yields slightly higher returns than annual compounding.

Time is another key factor in maximizing compound interest. The earlier you start investing, the more pronounced the compounding effect becomes. A small, consistent investment made over a longer period can grow more substantial than larger, sporadic deposits made later in life.

Albert Einstein reportedly called compound interest the “eighth wonder of the world,” underscoring its remarkable capability to amplify wealth. Recognizing its power to enhance savings is crucial for financial planning and establishing a robust wealth-building strategy.

The Power of Starting Young

Starting young in investing significantly elevates the potential for financial growth over a lifetime. Time is a crucial ally in leveraging compound interest.

Benefits of Early Investments

- Young investors create opportunities for wealth. Early investing maximizes the duration money has to grow, using compounding to build substantial returns.

- A $500 annual investment starting at age 20 may grow exponentially more by retirement age than starting even a decade later.

- Compounded growth from a young age means smaller contributions can amass large sums over decades.

Impact Over Time

- Time magnifies compounding’s effect.

- Consider two scenarios: one person invests $1,000 annually from ages 25 to 35, then stops, while another starts at 35 with the same amount through to retirement.

- Assuming similar interest rates, the former often ends up with more savings due to the long accumulation period.

- Starting early extends growth periods, leading to more opportunity for financial security and goal achievement.

The Importance of Staying Persistent

Staying persistent is crucial in harnessing the full potential of compound interest. Consistent effort in saving and investing fuels long-term financial growth, even when faced with market volatility.

Strategies for Consistency

Setting up automatic contributions ensures regular investment without the temptation to skip. I track my progress through financial apps that provide insights on how close I am to my goals. Budget adjustments let me accommodate savings without impacting everyday spending. By establishing these practices, I maintain a steady investment routine.

Overcoming Common Challenges

Fear of market downturns might derail investment plans. I remind myself that fluctuations are part of the investing landscape by focusing on long-term gains. Unexpected expenses sometimes disrupt my savings plan; I prepare for these with an emergency fund, helping me stay on course. By addressing these hurdles, I remain committed to my financial future.

Real-Life Success Stories

Experiencing the magnitude of compound interest can be transformative, as demonstrated by those who’ve successfully navigated its pathways. Real-life stories provide insight into the power of starting young and persisting with investments.

Examples of Early Investors

Consider the story of Chris Reining, who retired at 37. He started investing in his 20s, gradually building a substantial portfolio through consistent contributions and compound interest. Chris’s strategy involved low-cost index funds, allowing growth over two decades. His commitment to maintaining his investments despite market shifts underscores the importance of starting young.

Another example is Grace Groner, a secretary who lived frugally and invested $180 in Abbott Laboratories stock back in 1935. Over the years, her investment grew to over $7 million, demonstrating how consistent, long-term investing can lead to astonishing outcomes with the power of compound interest.

Lessons Learned

Key lessons emerge from these stories. Early investment maximizes the potential of compound interest, evidenced by Chris’s success. Investors benefit from starting as soon as possible, even with modest amounts, to capitalize on decades of compounding.

Another crucial lesson is the value of patience and consistency. Grace’s story teaches that steadfast investing, regardless of the initial amount, can yield remarkable results over time. Staying the course and focusing on long-term growth rather than short-term volatility is vital for maximizing compound interest.