Tax Planning Tips: Maximize Your Returns and Minimize Payments Effectively

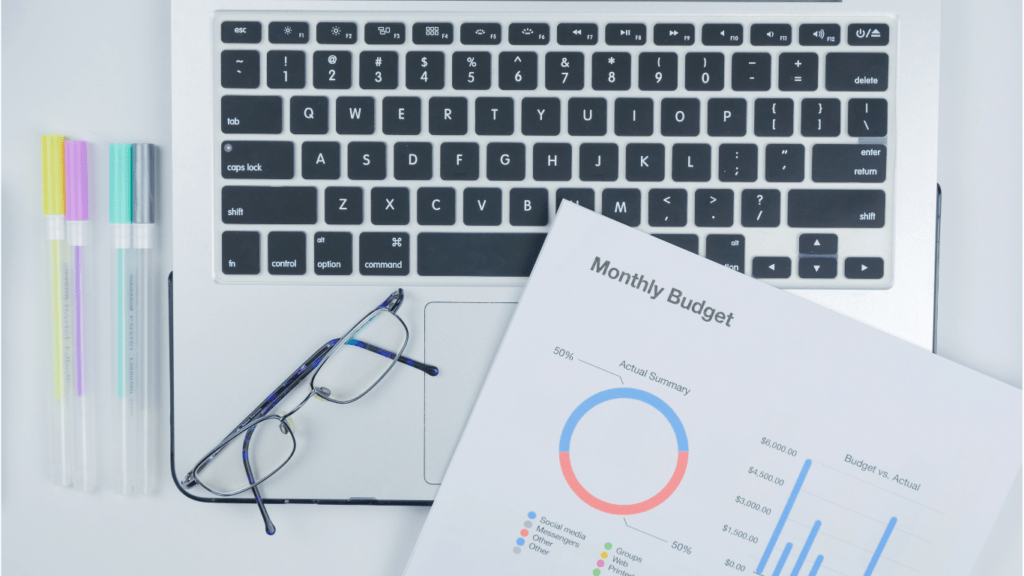

Understanding Tax Planning Effective tax planning plays a crucial role in managing financial obligations. It involves analyzing current financial situations and implementing strategies to minimize tax liabilities. With a solid approach, taxpayers can reduce taxable income, defer tax payments or take advantage of tax credits. Recognizing these facets promotes intelligent decision-making and contributes to long-term […]

Tax Planning Tips: Maximize Your Returns and Minimize Payments Effectively Read More »