Understanding the Importance of a Strong Credit Score

A strong credit score serves as a vital financial asset. Banks and lenders often rely on credit scores to evaluate the creditworthiness of potential borrowers. With a strong credit score, individuals may secure:

- favorable loan terms

- lower interest rates,

- quicker approval processes

Negotiating better credit card offers and terms becomes more feasible with high creditworthiness. Landlords frequently assess credit scores when evaluating rental applications. Possessing a robust credit score may improve a tenant’s chances of approval. Insurance companies also consider credit scores to determine premiums. Consumers with stronger scores might qualify for lower rates, resulting in significant savings.

Employers sometimes check credit scores during hiring processes. A solid score can reflect responsible money management and reliability, potentially influencing employment opportunities. In the context of major life purchases or changes, maintaining a strong credit score becomes increasingly beneficial.

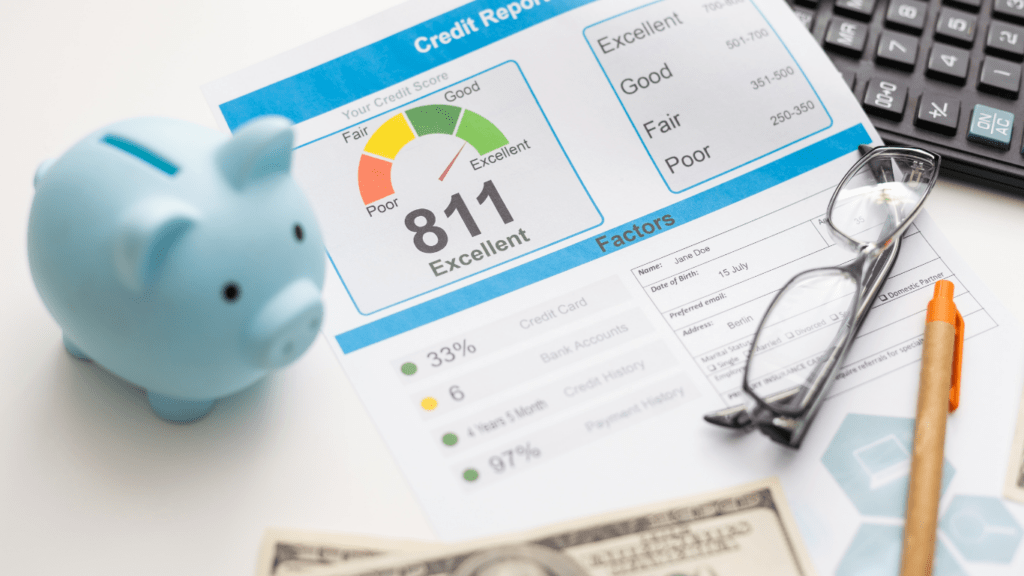

Factors Affecting Your Credit Score

Understanding the factors affecting your credit score helps in managing it effectively. Each component plays a significant role in shaping your overall score, influencing financial decisions, and opportunities.

- Payment History

Payment history significantly impacts your credit score. Late or missed payments can damage it. To maintain a strong score, paying bills on time is crucial. Timely payments demonstrate reliability to lenders.

- Credit Utilization

Credit utilization refers to the percentage of your credit limit you’re using. Keeping usage below 30% is advisable. High utilization can suggest over-reliance on credit and negatively affect scores. Regularly monitoring balances helps manage utilization rates.

- Length of Credit History

Length of credit history considers the age of your oldest and newest accounts and the average age of all your accounts. A longer history generally boosts scores as it shows experience in managing credit. Consistent account management over time strengthens this factor.

- New Credit Inquiries

New credit inquiries, or hard inquiries, occur when you apply for new credit. Multiple inquiries over a short period can lower your score. Limiting credit applications shows prudence in managing financial responsibilities.

- Types of Credit Accounts

Diversity in credit accounts, such as a mix of credit cards, retail accounts, installment loans, and mortgage loans, can benefit scores. A varied credit portfolio demonstrates the ability to manage different types of credit, which lenders view favorably.

How to Build a Strong Credit Score

Building a robust credit score involves strategic actions and consistent habits. It’s essential to understand and implement specific practices to improve financial credibility.

Establishing Credit Accounts

Opening a variety of credit accounts establishes a credit history. If starting from scratch, consider secured credit cards as an initial step. A small credit line demonstrates borrowing capacity. Diversifying with a mix of installments, such as loans, and revolving accounts, like credit cards, enriches the credit profile. Only open accounts as needed to avoid excessive inquiries.

Making Timely Payments

Consistently paying all credit accounts punctually is crucial. Enable automatic payments to ensure on-time billing. Timeliness accounts for 35% of the credit score, making it the most significant factor. If unexpected hardships arise, promptly communicate with creditors to negotiate a possible alternative repayment plan to prevent negative impacts.

Managing Credit Utilization

Keeping credit utilization below 30% strengthens a credit score. Monitor credit lines regularly to stay within this threshold. Utilize only a portion of available credit by spreading purchases across several cards or making mid-cycle payments to reduce reported balances. Strategically paying down existing debt can also lower utilization rates, enhancing creditworthiness.

Strategies for Maintaining a Strong Credit Score

Maintaining a strong credit score involves conscious, ongoing efforts. Performing regular reviews and strategic financial decisions greatly enhances creditworthiness.

Regularly Monitoring Your Credit Report

I make it a habit to check my credit report consistently, accessing free reports annually from each of the major credit bureaus. These reviews help me spot any inaccuracies or fraudulent activities that could negatively impact my score. By disputing errors promptly, I ensure my credit profile remains accurate.

Avoiding Unnecessary Debt

Whenever possible, I steer clear of debt that doesn’t serve my financial goals. Prioritizing debt repayment and avoiding impulsive credit card spending are key steps. This prudent approach helps me maintain credit utilization below 30%, highlighting financial stability to lenders.

Keeping Old Credit Accounts Open

I choose to keep my oldest credit accounts active even if I rarely use them. By doing this, I benefit from a longer credit history, which positively affects my credit score. Closing old accounts can inadvertently shorten my credit history and increase my overall credit utilization rate.

Common Mistakes to Avoid

Avoiding common pitfalls is essential when building and maintaining a strong credit score. Understanding and steering clear of these mistakes helps ensure financial stability.

Missing Payments

Missing payments can severely impact credit scores. Payment history accounts for 35% of credit scores, making timely payments crucial. Late or missed payments suggest financial unreliability to lenders, leading to potential negative marks on credit reports. Set up reminders or automate payments to avoid this pitfall.

Closing Old Accounts

Closing old accounts might seem beneficial, but it can actually harm credit scores. An older account helps maintain a long credit history, which positively affects scores. Unless an account has high fees, consider keeping it open to retain the benefit of a prolonged credit history.

Applying for Too Much Credit at Once

Applying for multiple credit accounts simultaneously can raise red flags for lenders. This practice results in hard inquiries that lower scores and suggest financial distress or increased reliance on credit. Instead, space out applications over time to minimize negative effects on credit scores.