What Is a Roth IRA?

A Roth IRA is an individual retirement account that offers tax-free growth and withdrawals if certain conditions are met. Unlike traditional IRAs, contributions to a Roth IRA aren’t tax-deductible, so you pay taxes on the money before it goes into the account. However, qualified withdrawals, typically after age 59½ and once the account has been open for at least five years, aren’t subject to federal income taxes.

The annual contribution limit for a Roth IRA is $6,500, with an additional $1,000 catch-up contribution allowed for those aged 50 and over. These limits may vary based on income levels; higher earners may have reduced contribution limits or be ineligible to contribute directly to a Roth IRA, though strategies like backdoor Roth conversions can help bypass these restrictions.

A Roth IRA provides flexibility, offering diverse investment options including:

- stocks

- bonds

- mutual funds

This flexibility aids in tailoring a portfolio to different risk tolerances and financial goals. Furthermore, Roth IRAs don’t require mandatory distributions, allowing funds to grow tax-free for longer periods, benefiting estate planning strategies. These attributes make Roth IRAs appealing to many individuals seeking long-term financial growth.

Benefits of Roth IRAs

Roth IRAs offer significant advantages that make them attractive for retirement savings, particularly in terms of tax-free growth and flexibility.

Tax-Free Growth

Contributions to a Roth IRA grow tax-free, providing a key advantage for long-term savings. Earnings remain untaxed if the account holder meets specific conditions, as Roth IRAs allow qualified withdrawals without incurring taxes. By investing in diverse assets such as stocks and mutual funds, individuals can maximize their potential returns, leading to increased retirement funds without the burden of future taxes.

No Required Minimum Distributions

Unlike traditional IRAs, Roth IRAs don’t mandate required minimum distributions (RMDs), granting more control over retirement savings. This unique feature allows account holders to decide when and how much to withdraw, enabling funds to grow uninterrupted. Consequently, Roth IRAs are beneficial for estate planning, as beneficiaries can inherit the account with less tax impact, extending the legacy and financial security.

How to Open a Roth IRA

Opening a Roth IRA provides the opportunity for tax-free growth and withdrawals. Understanding eligibility and selecting the right provider ensures a smooth setup process.

Eligibility Requirements

Meeting certain criteria allows me to open a Roth IRA. I check my modified adjusted gross income (MAGI); for 2023, it must be under $153,000 for single filers or $228,000 for joint filers. Age doesn’t restrict opening an account, but having earned income, like wages or salary, is essential. If my income exceeds limits, I may consider a backdoor Roth conversion.

Choosing the Right Provider

I choose a Roth IRA provider that aligns with my investment objectives and offers low fees for optimized growth. Financial institutions like banks, credit unions, and online brokerages offer these accounts. Comparing investment options, account management tools, and customer service helps me identify a provider fitting my financial goals. Some providers excel in user-friendly digital platforms, while others might offer diverse investment choices.

Funding Your Roth IRA

Funding a Roth IRA efficiently is key to maximizing its potential for tax-free growth. Understanding contribution rules and strategies ensures optimal use.

Contribution Limits

- The annual contribution limit for a Roth IRA is $6,500 for most individuals as of 2023.

- It’s vital to consider these limits when planning contributions.

- The IRS sets these limits based on age, with the standard amount applying to those under 50.

- Meeting these limits can significantly impact the account’s growth potential since contributions are post-tax, allowing earnings to grow tax-free.

- Incomes exceeding certain thresholds might reduce allowable contributions. For instance, single filers earning up to $153,000 can contribute the full amount, while those over $138,000 may see reductions.

- To fund a Roth IRA effectively, assess your income against these limits annually.

Catch-Up Contributions for Older Investors

For individuals aged 50 and over, catch-up contributions provide a valuable opportunity. An additional $1,000 can be contributed annually beyond the standard limit, making the total $7,500. Utilizing this provision can accelerate retirement savings.

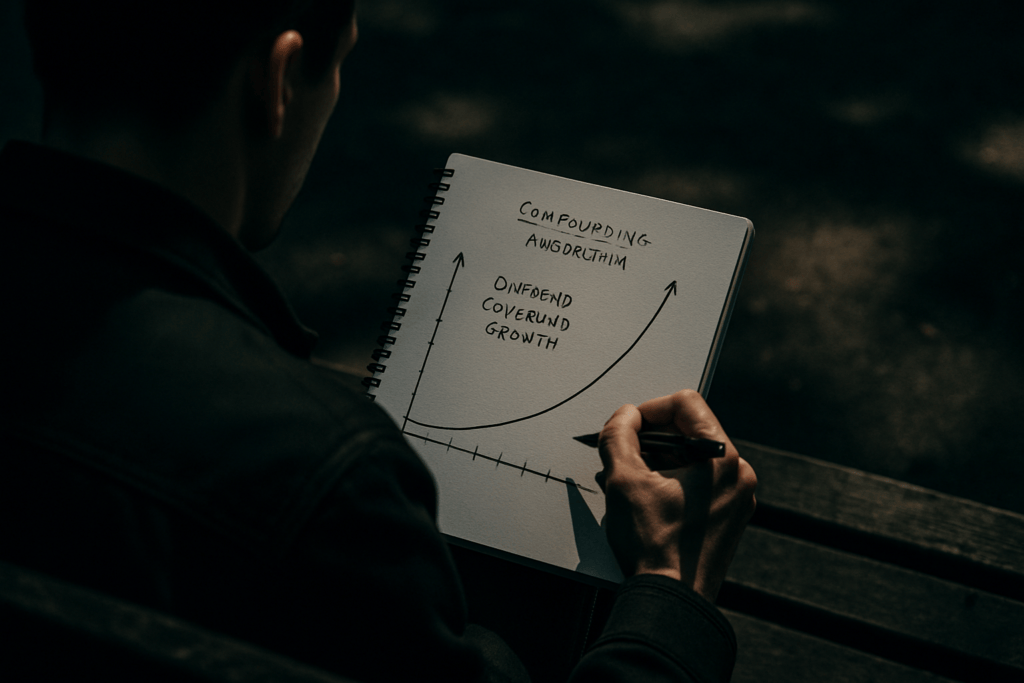

Contributing extra funds later in one’s career can make a substantial difference, especially if retirement planning began later than ideal. These additional contributions, when compounded over time, can enhance the growth potential of a Roth IRA, ensuring more substantial resources for retirement years.

Investment Strategies for Roth IRAs

Maximizing a Roth IRA’s tax-free growth potential involves strategic investment choices. Understanding the facets of diversification and focusing on long-term growth helps establish a robust retirement portfolio.

Diversification

Diversifying Roth IRA holdings mitigates risk and stabilizes returns. I invest in a mix of asset classes like stocks, bonds, and real estate investment trusts (REITs) to reduce exposure to market volatility. For example, a blend of domestic and international equities broadens my risk, while incorporating both growth and value stocks balances potential returns. Allocating a portion to bonds or bond funds cushions against equity market fluctuations.

Long-Term Growth Focus

Prioritizing investments with long-term growth potential compounds my Roth IRA’s value over time. I select equities with strong historical performance and solid prospects, like technology or healthcare stocks, aiming for sustained capital appreciation. Investing in index funds or exchange-traded funds (ETFs) provides broad market exposure and reduces individual stock risk. Patience in holding these assets over extended periods captures compounding benefits, aligning with my long-term retirement goals.